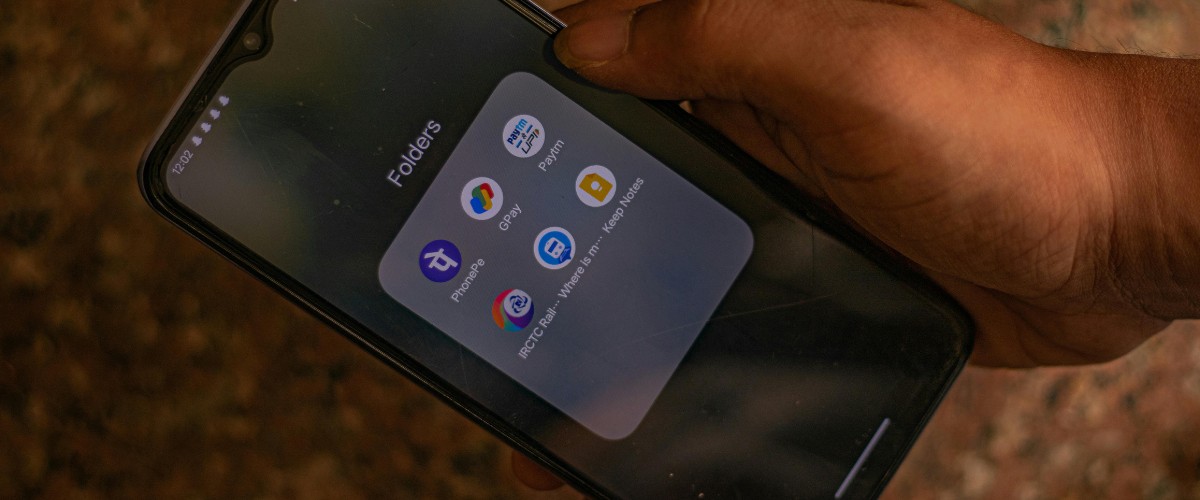

Paytm’s recent restructuring is more than just a corporate shuffle, it’s a masterclass in how startups can pivot, protect, and position themselves for long-term growth. If you’re building or backing a tech-driven business, here’s what Paytm’s moves can teach you about navigating the intersection of finance, technology, and cybersecurity solutions.

1. Simplify to Scale

Paytm’s parent company, One97 Communications, recently restructured to bring its financial and tech subsidiaries under direct ownership. This move aims to streamline operations, enhance transparency, and improve operational efficiency at Angelone.

Lesson: Complex structures can hinder agility and increase risk. For startups, especially in fintech and SaaS, keeping your organisational structure lean and clear can help you respond faster to market changes and regulatory demands.

2. Invest Where It Counts

Despite exiting real-money gaming, Paytm is investing ₹455 crore into its core businesses—Paytm Money and Paytm Services. This strategic allocation supports technology upgrades and team expansion in priority areas, AngelOne.

Lesson: Smart capital allocation is crucial. Invest in areas that directly impact your value proposition and customer experience. For fintech startups, this often means beefing up your cybersecurity solutions to protect user data and build trust.

3. Cybersecurity Isn’t Optional

After a significant breach in 2020, Paytm learned the hard way that robust cybersecurity is non-negotiable. The company was required to conduct a system audit, including a cybersecurity review, and submit its report to the Reserve Bank of India within six months, according to TechCrunch.

Lesson: Cybersecurity solutions should be baked into your business model, not tacked on as an afterthought. Investing in strong cybersecurity measures can prevent costly breaches and protect your brand’s reputation.

4. Compliance Is a Competitive Advantage

Paytm faced regulatory scrutiny due to non-compliance, leading to restrictions on its banking unit. The company acknowledged its shortcomings and emphasised learning from mistakes.

Lesson: Compliance isn’t just about avoiding penalties—it’s about building credibility with investors, customers, and regulators. Implementing strong cybersecurity solutions and adhering to regulations can set you apart in a crowded market.

5. Learn from the Past, Plan

Paytm’s CEO admitted that the company should have understood and fulfilled its responsibilities better. This reflection underscores the importance of learning from past mistakes to build a more resilient business.

Lesson: Regularly assess your cybersecurity posture and compliance status to ensure ongoing security and compliance. Use audits and feedback to strengthen your defences and ensure your business is prepared for future challenges.

Final Thoughts

Paytm’s restructuring offers valuable lessons for startups and investors navigating the complex landscape of finance, technology, and cybersecurity. By simplifying operations, investing wisely, prioritising cybersecurity solutions, ensuring compliance, and learning from past experiences, you can build a more resilient and trustworthy business.

Tags:

CybersecurityTech IndustryAuthor - Ishani Mohanty

She is a certified research scholar with a Master's Degree in English Literature and Foreign Languages, specialized in American Literature; well trained with strong research skills, having a perfect grip on writing Anaphoras on social media. She is a strong, self dependent, and highly ambitious individual. She is eager to apply her skills and creativity for an engaging content.